estate tax changes build back better

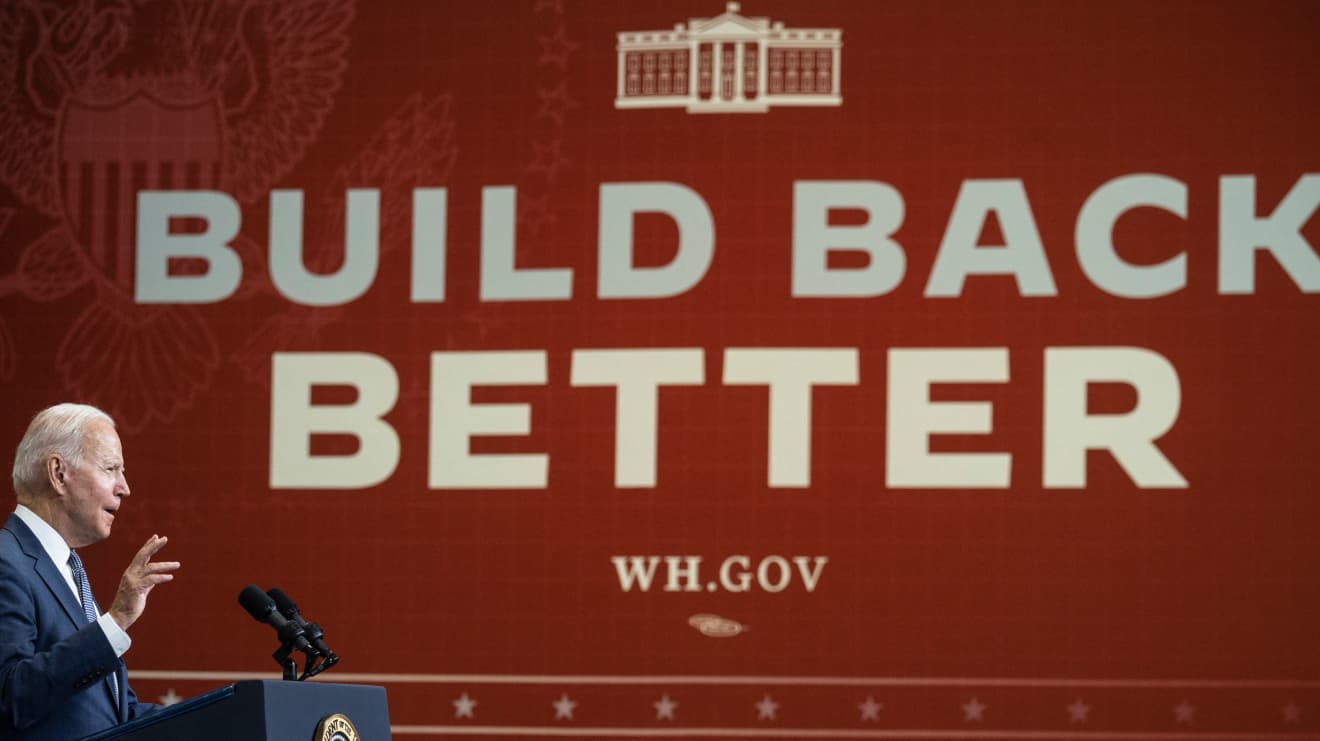

The Build Back Better Act HR. 28 2021 President Joe Biden announced a framework for changes to the US.

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Dont leave your 500K legacy to the government.

. The exclusion amount is for 2022 is 1206. The House Ways and Means Committee approving the tax provisions in President Bidens Build Back Better Act BBBA marks a significant first step towards the bills passage. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Day Pitney Generations Newsletter. Recently proposed tax law changes in the Build Back Better Act reconciliation bill the Bill which were approved by the House Ways Means Committee would affect individual taxpayers. 5376 would revise the estate and gift tax and treatment of trusts.

Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include. Included are numerous proposed tax changes that would impact. Ad Get free estate planning strategies.

Our tax expert weighs in. These proposals are currently under. House Rules Committee releases updated version of the Build Back Better Act initial impressions Substantial number of changes to the tax-related provisions of the bill.

December 6 2021. Estate and Gift Tax Exemptions The Biden framework does not. 5376 contains no modifications to the estate and gift tax exclusion amount or the basis step up rules.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117. Many families used what is known as the Biden 2-Step by making a relatively small gift to an irrevocable trust and then selling LLC or other interests to the trust in exchange. Larson Brown PA.

While many may breathe a sigh of relief. Adding in 207 billion of nonscored revenue that is estimated to. The House-passed version of the Build Back Better Act changes the base erosion provisions of Section 59A by gradually increasing the applicable percentage from 10 to 125.

Various senators support some proposals eg estate and gift changes and the Billionaires Income Tax that are not in the current bill. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the.

It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan.

So if the bill changes almost anything could be. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. As the draft stands the legislative.

The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years. Recently the text for the Build Better Back Act BBBA was released by the House Budget Committee. Revised Build Back Better Bill Excludes Major Estate Tax Proposals.

Joe Manchin could agree to a Build Back Better that keeps most of the Trump tax cuts. Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Joe Manchin D-WV talks on the phone outside of a lunch meeting with Senate.

The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. Economic Effects of the Updated House Build Back Better Act For purposes of estimating the bills impact on federal budget deficits interest payments and resulting.

3 version introduced an increase to the cap with a slightly higher. In late October the House Rules Committee released a revised. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in.

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

/PresidentTrump-3975bbb9a0e448b6a7a9b6db22281e41.jpg)

How Tax Cuts Affect The Economy

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

The Biden Plan To Build A Modern Sustainable Infrastructure And An Equitable Clean Energy Future Joe Biden For President Official Campaign Website

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Plan For Climate Change And Environmental Justice Joe Biden

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Which Classic Tax Strategies Are At Risk In A Democratic Congress

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Biden S Big Social Spending Bill Probably Will Pass Senate This Month Without Many Cuts To It Analysts Say Marketwatch

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times