hotel tax calculator illinois

2 of 98 tax on gross receipts in. State has no general sales tax.

The Deadliest Roads In Illinois Moneygeek Com

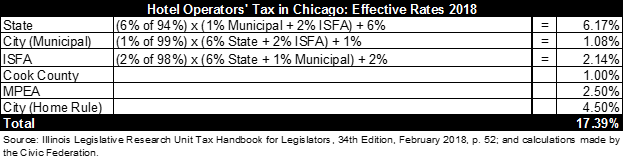

The hotel operators occupation tax in Illinois is as follows.

. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. Other local-level tax rates in the state of Illinois include home. Name Description MyTax Illinois.

The following local taxes which the department collects may be imposed. Usually the vendor collects the sales tax from the consumer as the consumer makes a. If filing a tax period prior to April 2011 call 217 785 6606 to obtain the correct form.

The tax is reported on. You may also send. Depending on local municipalities the total tax rate can be as high as 11.

Hotel Operators Occupation Tax Return R-0513 NOTE. FormFiling Payment Requirements. The Illinois IL state sales tax rate is currently 625.

State hotel tax rate. From august 2019 through january 2022 my average hotel accident settlement was 147500im talking about hotel negligence cases that i handled. 4 Specific sales tax levied on accommodations.

If you have any questions please contact the Department during business hours Monday through Friday from 830 am. Your average tax rate is 1198 and your marginal tax rate is. Hotel Tax Calculator Illinois.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation 2 of 98 tax on gross receipts. 6 of 94 of gross receipts.

Illinois Income Tax Calculator 2021. FormFiling Payment Requirements The tax is reported on Form RHM-1 Hotel. Illinois has a 625 statewide sales tax rate but also.

At 312 603-6870 and press option 7. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Except as noted on their respective pages the preprinted rate on the return will include any locally imposed taxes.

The Illinois Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. The Federal or IRS Taxes Are Listed.

Statutory - 65 ILCS 58-3-13 T ax Rate. Statutory - 70 ILCS 21013c Tax Rate Use the Tax Rate Database to determine the rate. If you make 70000 a year living in the region of Illinois USA you will be taxed 11737.

Just enter the wages tax withholdings and other information required. Tax Calculators Tools Tax Calculators Tools. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Use the Tax Rate Database to determine the rate. Illinois Sports Facilities Authority hotel tax. The Hotel Accommodations Tax remains 45.

The tax is imposed on the occupation of renting leasing or letting rooms to persons for living quarters for periods of less than 30 consecutive days. Illinois Income Tax Calculator 2021. It costs 134 to.

Your employer will withhold money from each of.

How To Use Life Insurance To Pay Estate Taxes

Idr Property Tax Tax Rate Lookup

Illinois Beach Hotel Zion Il 1 Lakefront 60099

Illinois Graduated Income Tax Proposal Rejected Ap Projects As Pritzker Backed Committee Concedes Defeat Nbc Chicago

Illinois Farm Family Business 2019 Budgets Don T Forget Family Living Costs Agfax

Here Illinois Health Care Association

States With The Highest Lowest Tax Rates

No The Mega Millions Jackpot Winner Didn T Pay 70 In Taxes

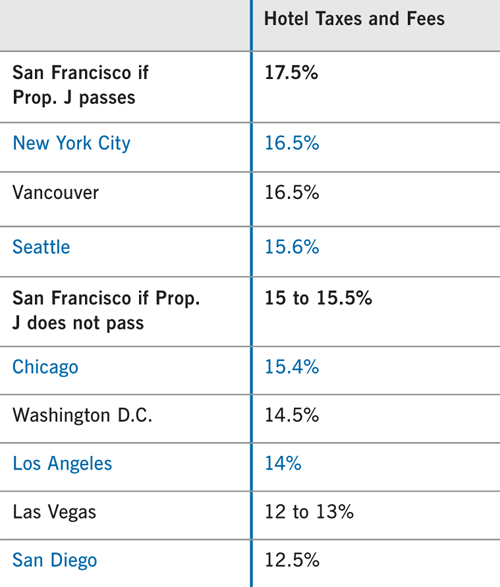

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Chicago Illinois Sales Tax Rate Is 10 25

Guide To The Lowest Property Taxes In Pa Psecu

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

What You Need To Know About The Graduated Income Tax Proposal On Your Ballot This Election Nbc Chicago

Il Online Sports Betting Best Sportsbooks Apps In Illinois

Proposition J Hotel Tax Increase Spur